FinTech Consultancy

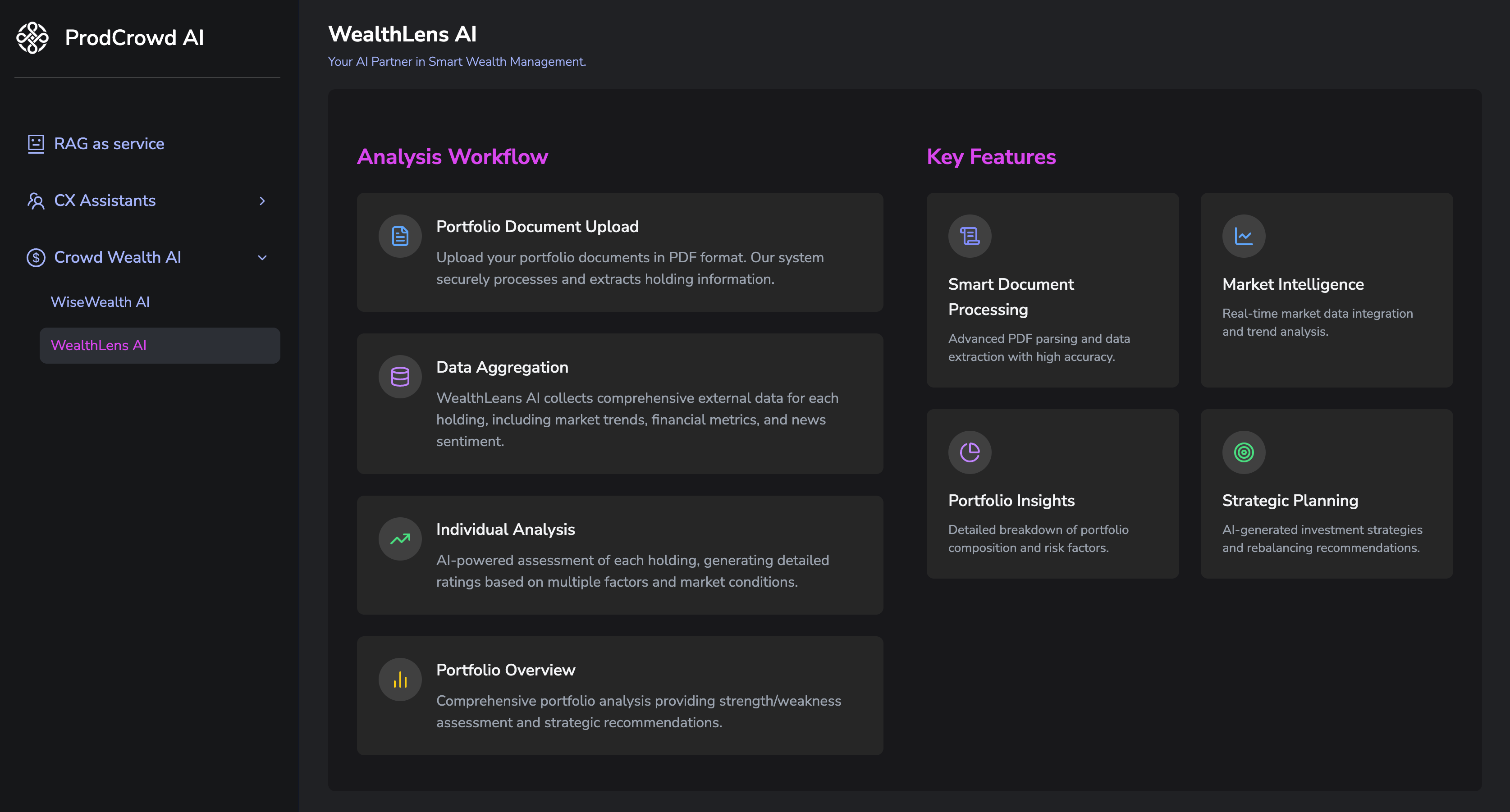

Time-consuming manual analysis and disconnected data sources made it difficult to identify actionable insights.

A lack of real-time data hindered the firm’s ability to anticipate market shifts and adjust its investment strategies accordingly.

The firm risked falling behind in the fast-paced venture capital space, unable to quickly identify emerging markets and track portfolio performance effectively.

AI analyzed global wealth distribution, pinpointing high-growth potential in emerging markets, such as sustainable energy in underserved regions.

The system used advanced analytics to forecast market trends and anticipate shifts, allowing Horizon Capital to make proactive investment decisions.

Financial data was consolidated into easy-to-read, interactive dashboards, simplifying the decision-making process for investors.

Real-time performance monitoring provided actionable insights, allowing the firm to track the success of its investments and adjust strategies as needed.